VANCOUVER, BC, December 28, 2022 – Nevada King Gold Corp. (TSX-V: NKG; OTCQX: NKGFF) (“Nevada King” or the “Company”) is pleased to review significant advancements at its 100%-owned Atlanta Gold Mine Project resulting from its 2022 exploration campaign. The 2022 program followed on from the Company’s 2021 inaugural drill program, which returned significant intervals of high-grade gold mineralization within the historic pit, and more importantly discovered high-grade gold mineralization in a new target area approximately 560m north of the pit. This review is followed by a discussion of a new geologic model and associated high priority targets, starting on page 4 of this release.

Atlanta Exploration Highlights:

- The 2021 work led to significant advancements in the understanding and modelling of the gold distribution at Atlanta, a process that continued to progress through 2022 as a result of over 1,800 metres of diamond drilling and 24,260 metres of reverse circulation drilling by Nevada King.

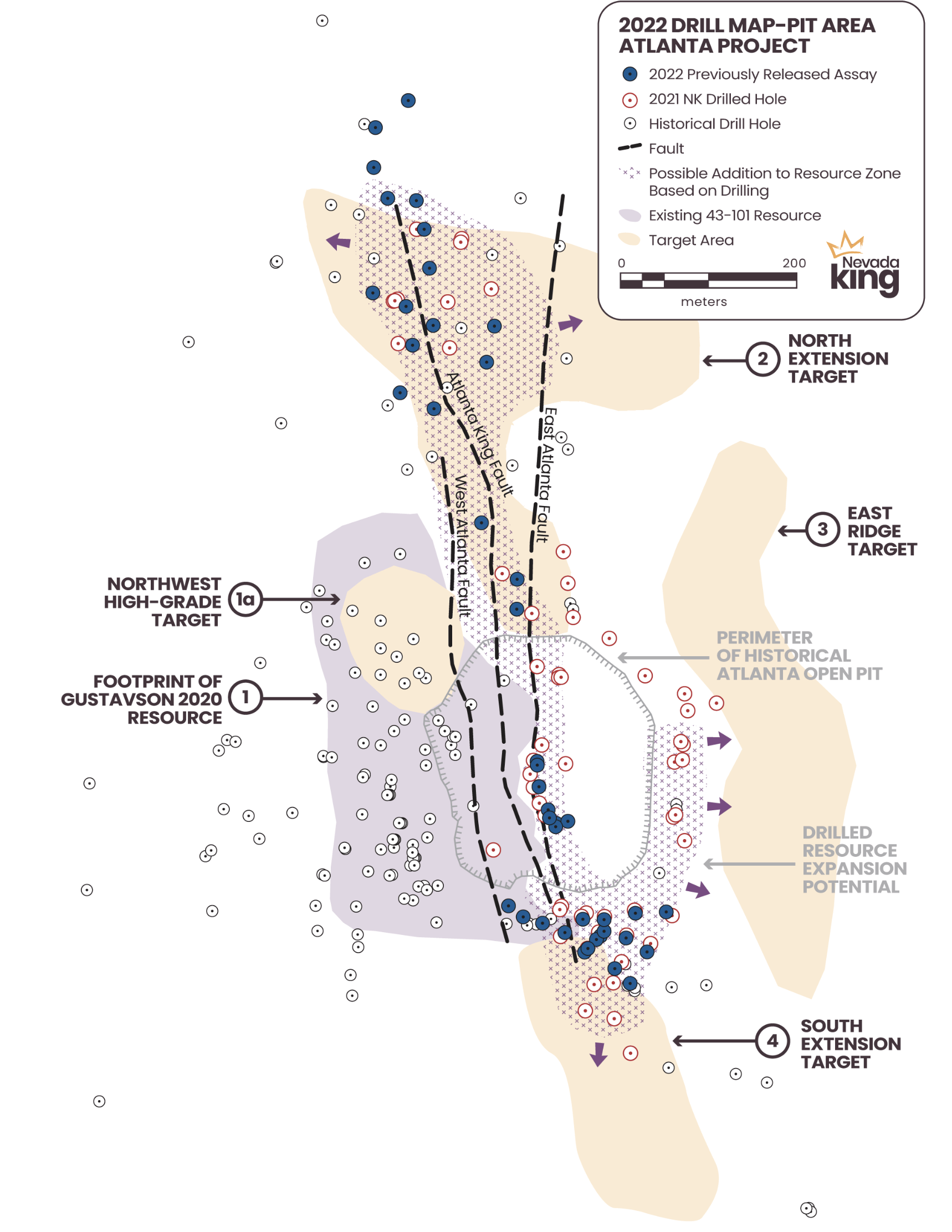

- As a result, a number of significant target areas and potential zones for resource growth at Atlanta have been identified that expands gold mineralization well beyond the footprint of the existing resource area (Figure 1). Further, mineralization in these newly identified target areas is generally open along strike and to depth and will be the primary focus of the 2023 drill program.

Atlanta Gold Zones Identified and 2023 Targets:

- Intercepts of 5.34 g/t over 54.9m, 3.35 g/t Au over 64.1m, and 2.65 g/t Au over 50.3m, all in oxide material and starting at surface, from within the Atlanta pit, (see January 12, 2022 and January 20, 2022 releases).This was followed up by a parallel fence of holes with oxide intercepts of 3.41 g/t Au over 54.9m, 2.65 g/t Au over 50.3m, and 2.23 g/t Au over 51.8m, (see October 18, 2022 release). (Atlanta Pit Zone)

- Extension and strengthening of gold mineralization moving south of the Atlanta pit with oxide intervals of 1.49 g/t Au over 120.4m and 1.38 g/t Au over 57.9m (see September 13, 2022 release). Additional results in this zone include 0.62 g/t Au over 77.7m, 0.82 g/t Au over 42.7m, 0.86 g/t Au over 56.4m, 1.71 g/t Au over 25.9m, and 1.77 g/t Au over 30.5m. (South Extension Target)

- Expanded mineralization to over 600m north of the Atlanta Pit, increasing the footprint of the North Extension Target (“NET”), with intercepts of 1.77 g/t Au over 19.8m, 1.67 g/t Au over 24.4m, and 0.71 g/t Au over 44.2m. Should the NET mineralization tie into the existing resource, it would double the overall gold resource footprint at Atlanta (see November 23, 2022 and December 20, 2022 releases). (North Extension Target)

- Identified the potential feeder structure for the high-grade gold at Atlanta with the Atlanta King Fault, intercepting 3.19 g/t Au over 32m and 2.9 g/t Au over 28.1m, (see December 5, 2022 release). (Atlanta King Fault)

- The Northwest High-grade Target (“NWT”)and the East Ridge Target (“ERT”) represent significant target areas ripe for expansion, where drill holes are pending release and being planned.

Corporate Highlights:

- Drilled 29,125 metres across three projects – Atlanta (20,500m), Iron Point (5,400m), and Lewis (3,225m), with results pending at all three projects.

- Continued to add to its strategic landholdings along the Battle Mountain Trend via staking. The Company will make an announcement in the New Year updating its mineral claim tenure.

- Raised $15.75 million in 2022 in two financings at a price of $0.45 per share,with the Company ending 2022 with over $10 million in cash.

- Founder & CEO Collin Kettell participated in the financings for $6.75 million and bought $742,000 in stock through open market purchases throughout the year.

- Appointed Gary Simmons as metallurgical consultant and demonstrated average gold cyanide solubility of 86.7% across 986 samples covering the Atlanta project (see July 5, 2022 release).

- With the significant exploration success supported by this significant funding the Atlanta 2022 program was expanded from an initial 13,100m to 20,000m (see November 15, 2022 release).The Company has now exceeded 20,000m and is planning to provide guidance on a further increase in early January.

- Added William Hayden, a highly experienced geologist with significant involvement in the Ivanhoe group of companies since 1994, to the Board of Directors, as well as bolstered its Technical Team with the addition of former Newmont geologists Lewis Teal and Mac Jackson.

Figure 1 provides the current geological modelling, the new discoveries, and the high priority 2023 targets at Atlanta. In summary, drilling to date has significantly increased the Company’s confidence in the potential for additional high-grade gold discoveries along the Atlanta Mine Fault Zone (“AMFZ”), with the potential of adding to the existing resource as well as upside from testing new targets.

Collin Kettell, Founder & CEO of Nevada King, stated: “2022 has proven to be a pivotal year for Nevada King with the successive exploration accomplishments unfolding at Atlanta. Today’s release of the updated working model and description of the associated target areas provide a roadmap to potential resource expansion and future exploration success. While detailed, I encourage everyone to read the overview of this new geologic model starting on page 4 below.”

Regarding the outlook for 2023, Mr. Kettell stated: “As we enter the new year, we will take the findings from our 2021 and 2022 drilling, and continue to apply them in our search for gold. An oxide gold system in the world’s number 1 mining jurisdiction is a rarity and we believe that we are in the midst of such a discovery. As such, I believe that the market is only starting to value the impact of these recent successes. Nevada King is looking forward to an even brighter 2023, and on behalf of Management and the Board, I would like to thank our entire team, with special thanks to Exploration Manager Cal Herron in his tireless effort to unlock the potential of Atlanta.”

Atlanta History, Geologic Model & Target Description

Historical Overview

Prior to Nevada King’s 2021 exploration program, there was only one obvious exploration target at Atlanta, this being the Gustavson 2022 Resource Zone (“GRZ”), which is shown as the surface projection in Figure 1. Other than drilling many long angle holes west of the Atlanta pit in order to track the historically mined Atlanta Fault down-dip to the west, very little historical effort was made to expand known mineralization to the north, east, and south. Widely spaced holes were drilled by previous operators north of the pit in what is now the North ExtensionTarget (“NET”) but the results were disappointing and the area’s resource potential was considered too low to pursue further work. In like manner, the area south of the Atlanta pit was considered to have limited potential due to the prevailing idea that the mineralization was cut off to the south by an E-W fault that bounds the southern end of the pit. Any mineralization occurring east of the pit was dismissed as being remnant “scraps” left over from the 1975-1985 mining operation, while surface gold anomalies occurring further east along the ridge (now Nevada King’s East Ridge Target or (“ERT”)) were interpreted as thin scabs produced by shallow, supergene gold enrichment. Consequently, significantly mineralized historical drill intercepts along the southern rim of the pit were not followed southward into what is now the South Extension Target (“SET”) and the ERT was never drill-tested.

Historical Gold Mineralization Model at Atlanta

Prior to Nevada King’s involvement, most of the previous explorers believed that the gold mineralization at Atlanta relied on a single, 45 degree west-dipping fault called the Atlanta Fault, that served as both the main conduit for Au-bearing fluids and main host for mineralization. All previous explorers at Atlanta adhered to this model, planning their drill holes and interpreting the results based on a single fault along which mineralizing fluids were introduced into the silicified fault breccia zone separating intrusive and volcanic rocks in the hanging wall from dolomite and quartzite in the footwall. Thicker versus thinner zones of mineralization were explained as simple pinch and swell along the fault, while fluctuations in dip were attributed to “rolling” down the fault plane. Aside from higher grades attributed to an east-west trending fault at the SE end of the pit, the existence of multiple fluid conduits with potential for localizing higher grade mineralization along the silica breccia zone was generally considered insignificant at best. The target was simple, and the hit-or-miss drill results obtained along strike and down-dip in spite of a relatively high hole density ultimately yielded a relatively small and low grade deposit within the GRZ, while the surrounding gold potential was discounted and either sparsely drilled or never tested.

A New Evolving Model for Atlanta

Nevada King was initially interested in Atlanta because of the district-scale potential for a larger deposit within a resurgent caldera environment largely covered by post-mineral volcanics and sediments. Potential for expanding the GRZ looked limited based on historical exploration and the prevailing model. Ground exploration started in early March 2021 with district-scale soil and rock sampling, which included the Atlanta pit and surrounding area, but the Company’s work largely focused on defining new targets outside of the GRZ within the much larger, surrounding mineral district.

Mineralization is well exposed across the eastern half of the Atlanta pit, but gaining access to the old benches for sampling and mapping was difficult. However, adhering to an important exploration axiom – ‘go where others won’t’ – Company field crews sampled and mapped the eastern benches in detail, which revealed gold mineralization in densely silicified, near-horizontal carbonate beds cut by northerly striking, near vertical faults hosting heterolithic, explosive tuff breccia and rhyolite dikes. Assay results showed the higher grades to be concentrated along the high-angle faults and adjacent silicified collapse breccia developed in the carbonate section. The Company saw no evidence for a 45o west-dipping Atlanta Fault as posited by the historical structural model, nor did it see any sign of the E-W fault that supposedly cut off mineralization south of the pit. Nevada King did however see good evidence for multiple fluid pathways along high-angle faults cutting the silicified breccia zone. Based on these observations, the Company decided to drill a limited number of shallow RC holes east of the pit and along the southern extension of the high-angle mineralized faults observed in the pit wall. From the intial holes, a pattern of down-faulted blocks moving westward across the pit became apparent, corroborating the Company’s geologic mapping in the pit. From there, the program was extended and holes were drilled westward across the southern end of the pit in an effort to find the Atlanta Fault.

The Company also focused drilling north of the pit to follow the pattern of steeply dipping faults toward the low grade historical holes in the NET, now looking for the step-down pattern of fault blocks that seemed to be important for introducing hydrothermal fluids into the silica breccia contact and adjacent carbonates. Historical holes indicated a 50m to 80m vertical offset somewhere between clusters of holes drilled by Kinross, located west of the county road, and a cluster drilled by Meadow Bay, located east of the county road. Nevada King drilled two fences of holes across this gap between the two historical hole clusters and hit high-grade mineralization within the fault offset zone in AT21-003. This added new life to the NET and proved that the down-drop fault model applies to the entire Atlanta deposit, not just to the pit area. As the understanding of the major controls to the gold mineralization developed, the potential increased for finding more gold mineralization in areas previously thought to lack potential. Another important exploration axiom – ‘don’t get model-bound’ – certainly applies to Nevada King’s experience at Atlanta and will continue to do so in the ongoing interpretive work.

Current exploration targets being actively explored at Atlanta are summarized below.

1 – Gustavson Resource Zone (“GRZ”) and Northwest High-Grade Target (“NWT”)

The Gustavson 2020 NI 43-101 resource model relies on the historical Atlanta model and includes holes that in some cases have poor drill recovery and uncertain collar locations. As such, the Company was certain the model needed to be re-visited. This decision was catalyzed by the five high grade holes drilled in the bottom of the Atlanta pit and reported on January 12, 2022 and January 20, 2022, which included intercepts of 5.34 g/t Au over 54.9m, 3.35 g/t Au over 64.1m, 3.94 g/t Au over 41.2m, and 2.32 g/t Au over 48.8m. Following these results, the Company began looking closely at the distribution of high-grade gold intercepts within the Gustavson resource model and noted numerous gaps that might be explained by: (1) failure to fully penetrate the high-grade silica breccia zone or (2) angle holes that missed the mineralization by drilling through a fault plane that had down-dropped the breccia horizon, essentially juxtaposing weakly mineralized hanging-wall volcanics next to the barren dolomite footwall that underlies the sub-horizontal breccia horizon. This evaluation set the stage for the current 2022 drilling program that seeks to accomplish two goals: (1) to increase both grade and tonnage throughout the GRZ by defining individual fault blocks and identifying the high-angle feeder structures (the fluid pathways) responsible for higher grade mineralization and (2) to put the northern and southern extensions of the AMFZ together with the ERT into the resource category.

As shown in Figure 1, the Company’s drilling within the GRZ has defined three major, northerly trending, steeply dipping fault strands comprising the AMFZ – the East Atlanta Fault (“EAF”), the central Atlanta King Fault (“AKF”), and the West Atlanta Fault (“WAF”). The central (“AKF”) is a major, pre-caldera district-scale structure that vertically displaced the Paleozoic basement hundreds of meters, juxtaposing older quartzite on the west from younger dolomite on the east. This deep structure focused explosive intrusive activity and associated mineralizing fluids following formation of the early Tertiary-age caldera that contains the entire Atlanta District.

Meanwhile, the shallow, historical underground and open pit Atlanta Mine was centered on the EAF where mineralization is confined to the relatively flat-lying silica breccia contact zone separating the Tertiary volcanics from underlying Paleozoic dolomite. The EAF focused higher-grade mineralization where it cut the silica breccia horizon, which was mined underground in the early days.

Unlike the EAF, mineralization associated with the AKF and WAF is completely blind at the surface and was not discovered until Goldfields and Kinross drilled deeper exploration holes in 1989-1999. Meadow Bay confirmed this deeper mineralization with its 2011-2015 drilling program and extended it into the Northwest High-Grade Target (“NWT”), but all three explorers experienced the same technical problems: failure to fully reach or penetrate the mineralized zone, thereby missing higher grade material. Nevada King has also experienced these problems with its own drilling, but the 2022 program has been utilizing vertical, deeper, and more closely spaced holes in order to achieve better sample recovery and determine depths to top and bottom of the mineralized horizon.

In contrast to the shallow mineralization along the EAF, the style of gold mineralization changes west of the AKF. Quartzite forms the footwall for the sub-horizontal silica breccia contact, and mineralization extends upward into the overlying volcanic sequence, which is not seen east of the fault. This is particularly apparent west of the AWF where gold-bearing fluids travelled upward along the fault and produced a “plume” of mineralization within the volcanic section extending 100m to 200m above the silica breccia zone. This plume-like mass of mineralization is most apparent in the NWT where several deep holes drilled by Meadow Bay in 2011-2015 encountered anomalously thick low grade mineralization punctuated by narrow high-grade intervals. Meadow Bay partially closed-off this mineralization further to the west of the target area but did not effectively follow the mineralization to the north, east, and south – in part due to holes that did not go deep enough to hit the high grade zones. Nevada King’s initial holes within the NWT established the presence of deeper mineralization, so our current program is now drilling deeper, gradually expanding the mineralized envelope in all three open directions with the objective of tying it into the NET to the north and into the main GRZ along the AMFZ where higher gold grades are anticipated.

2 – North Extension Target (“NET”)

The northward extension of the AMFZ projects into a completely covered area that was historically tested with widely spaced holes drilled by Goldfields, Kinross, and Meadow Bay. Nevada King’s 2021 program tested a gap within the historical drill patterns that turned out to be the AMFZ, where significantly higher gold grades were encountered compared to the adjacent historical holes (see November 22, 2021, release). These initial results prompted additional holes in 2022 and results received to date extend the mineralization in all directions with a possible exception along the target’s northern boundary where a fault has either terminated or laterally displaced mineralization. As with the mineralization observed along the EAF in the pit area, gold mineralization occurs within the sub-horizontal silica breccia horizon at the contact between dolomite in the footwall and un-mineralized volcanics in the hanging wall. Drilling within the target will resume in early 2023 to further expand and better define the zone.

3 – East Ridge Target (“ERT”)

The ERT was initially identified by Kinross in grid soil and rock sampling conducted in 1998, but for a number of reason all previous explorers considered the target to have little if any mineral potential. Consequently, the zone was not historically drilled. Nevada King confirmed the Kinross surface anomalies with its own soil and rock sampling in early 2021 and found mineralized explosive tuff dikes cutting up through the carbonate sequence as seen in the Atlanta pit. Drilling by the Company in 2021 along the eastern side of the Atlanta pit showed gold mineralization continuing eastward into and underneath the East Ridge, and at that point the ERT area took on a new significance. This target area is large, measuring roughly 120m wide by 700m long, and hosts significant potential if gold mineralization does indeed extend eastward from the pit as suggested by drilling to date. The Company plans to initiate drilling this target area in early 2023.

4 – South Extension Target (“SET”)

The Company’s 2021 drilling extended gold mineralization 200m southward from the Atlanta pit along the AMFZ and the mineralization remains open to the south where it is obscurred by a thick cover of landslide and colluvial debris. The first holes drilled in 2022 further widened the target zone and hit much higher grade mineralization (see September 13, 2022, release along Sections A-A’ and B-B’). This zone remains open to the south where the Company is currently planning new hole fences that will be drilled in early 2023.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by National Instrument 43-101 (“NI 43-101”).

About Nevada King Gold Corp.

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016 Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million-ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King’s portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines’ large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada.

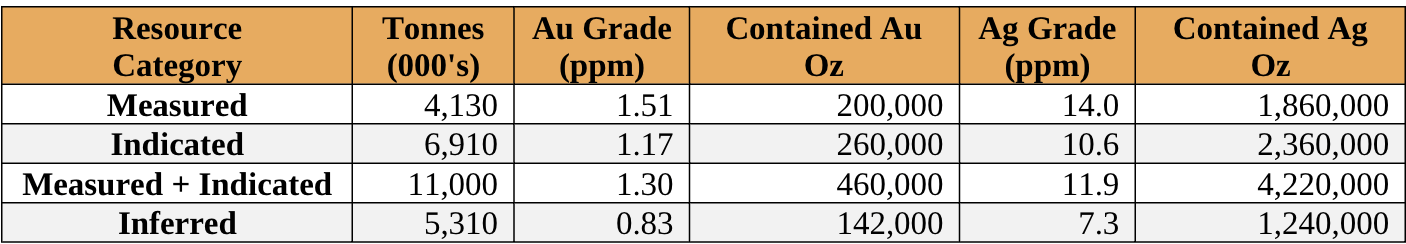

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR (www.sedar.com).

NI 43-101 Mineral Resources at the Atlanta Mine

Please see the Company’s website at www.nevadaking.ca.

For more information, contact Collin Kettell at collin@nevadaking.ca or (845) 535-1486.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating the future operations and activities of Nevada King, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or “should” occur or be achieved. Forward-looking statements in this news release relate to, among other things, the Company’s exploration plans and the Company’s ability to potentially expand mineral resources and the impact thereon. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Nevada King, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability to complete proposed exploration work given the global COVID-19 pandemic, the results of exploration, continued availability of capital, and changes in general economic, market and business conditions. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Nevada King does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.