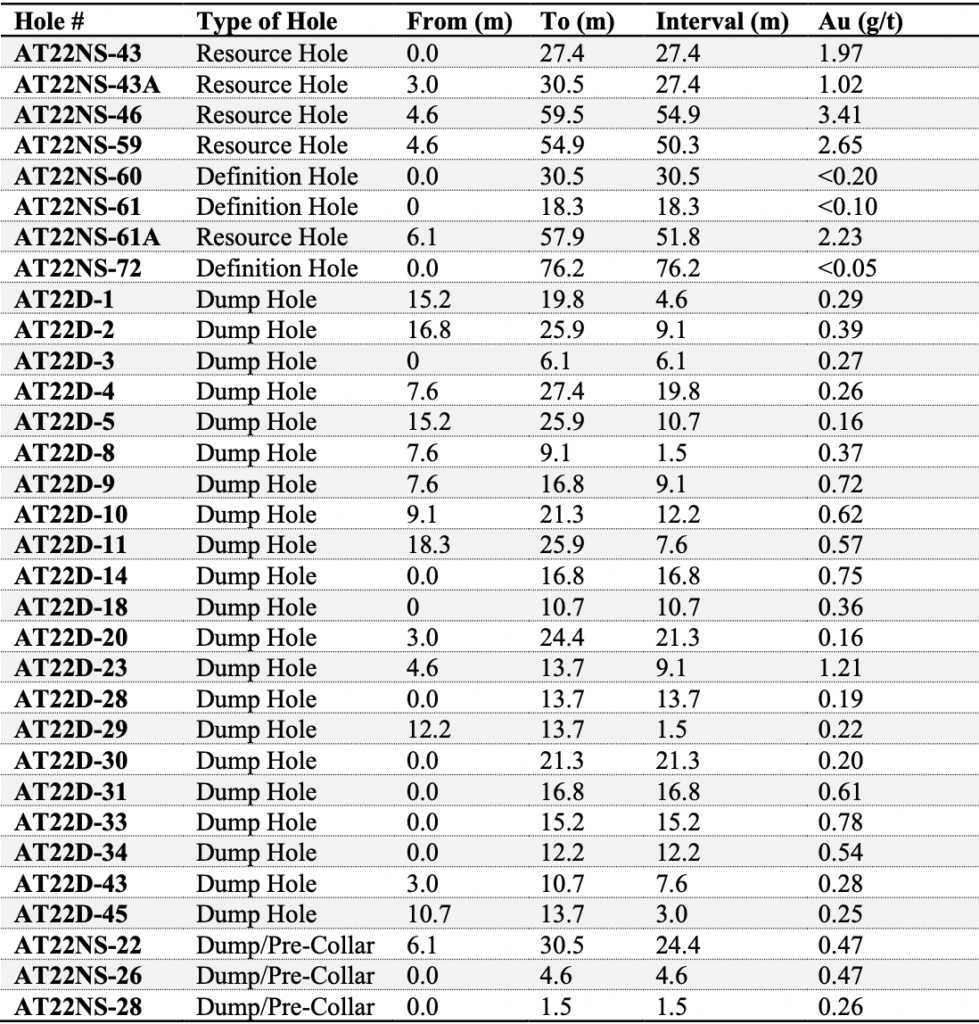

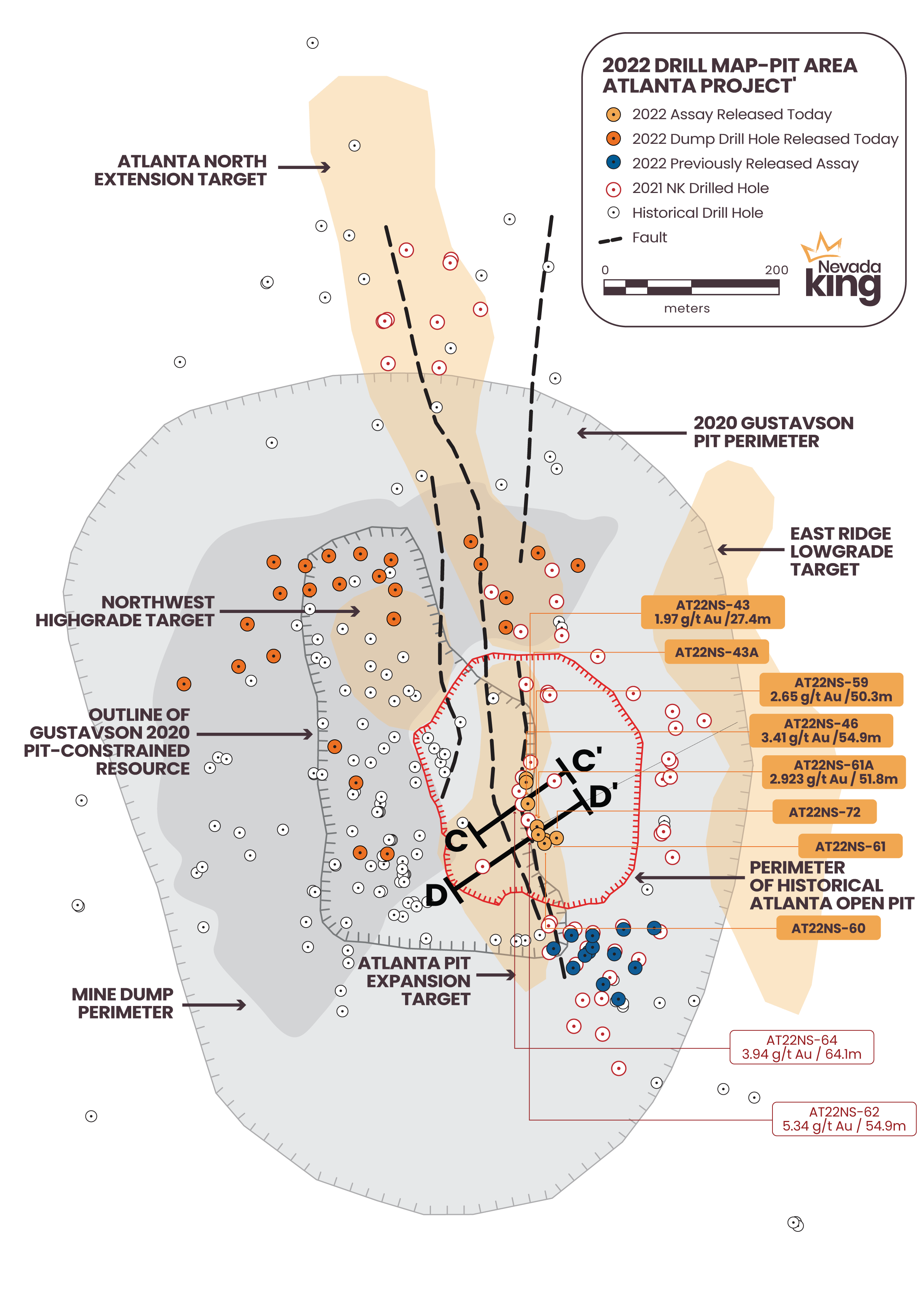

VANCOUVER, BC, October 18, 2022 – Nevada King Gold Corp. (TSX-V: NKG; OTCQX: NKGFF) (“Nevada King” or the “Company”) is pleased to announce assay results from 32 reverse circulation (“RC”) holes recently completed at its Atlanta Gold Mine Project located 264km northeast of Las Vegas, Nevada, in the prolific Battle Mountain Trend. This drilling includes eight holes designed to further define the high-grade Atlanta Mine Fault Zone (“AMFZ”) at the bottom of the historical Atlanta pit, together with 24 shallow holes drilled to test waste dumps from previous mining north and west of the historical pit.

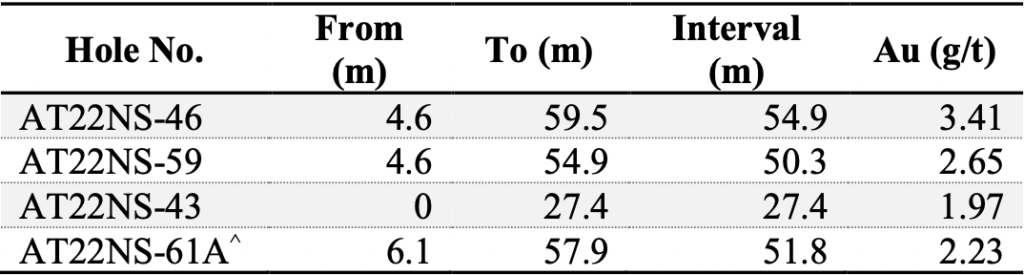

AMFZ Expansion Drilling Highlights:

^Denotes angle hole. True widths are unknown at this time.

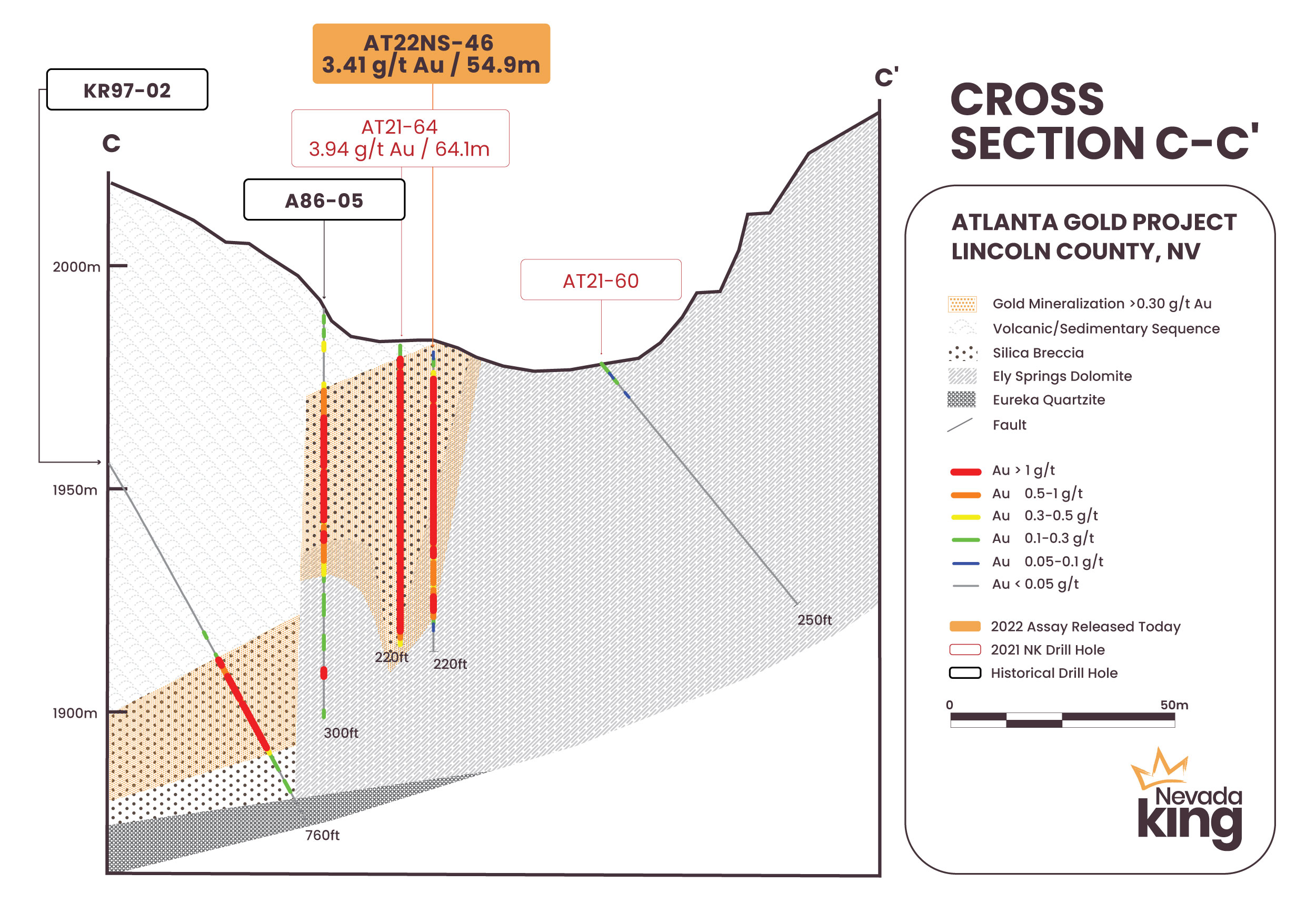

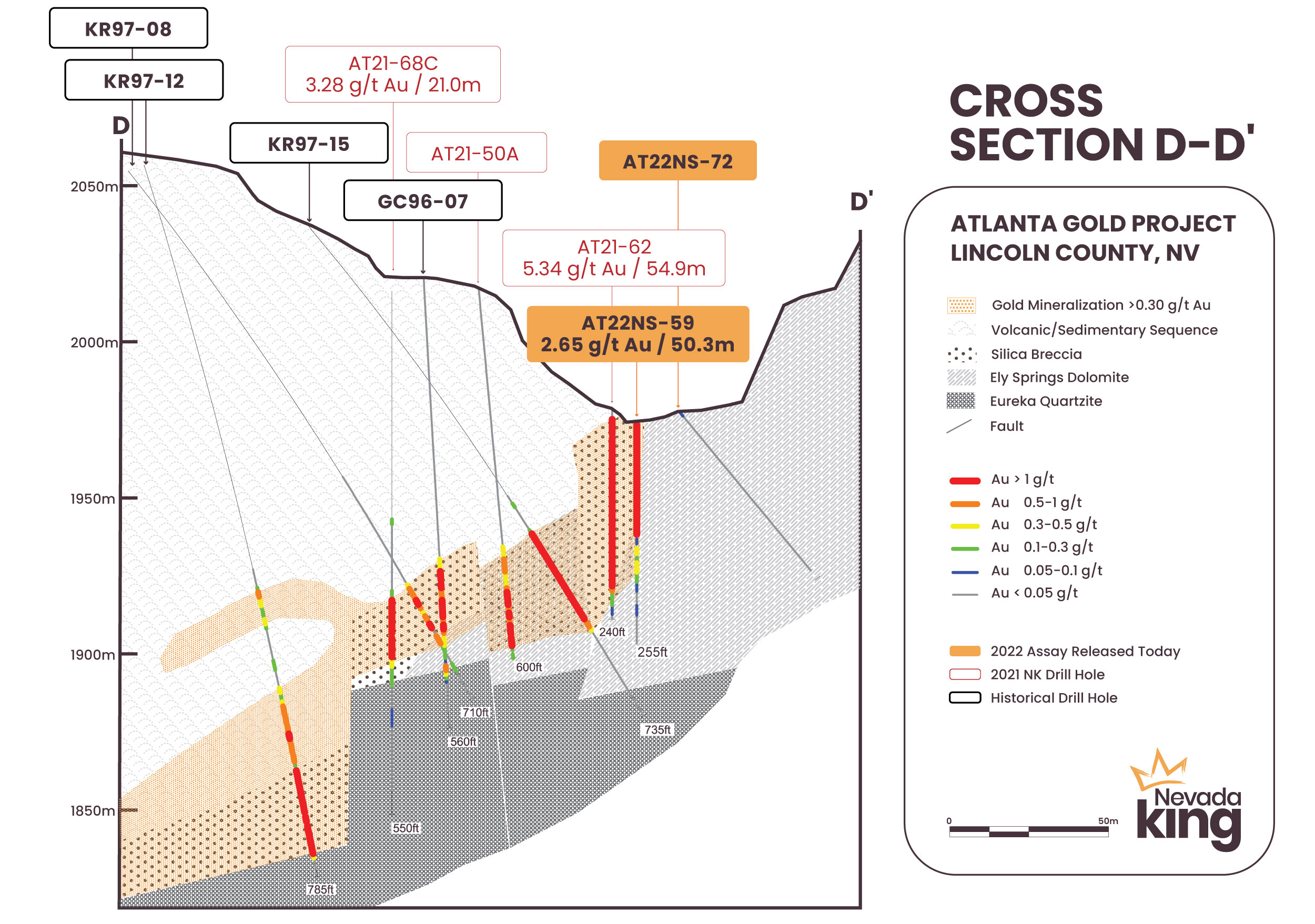

- These four high-grade intercepts in oxide have conclusively defined the footwall contact of the high-grade AMFZ, including its steep westward dip (Figures 1, 2, and 3). These holes were collared at the bottom of the historical pit roughly 10m east of the north-south fence of high-grade holes drilled by the Company in 2021, which intercepted 54.9m of 5.34 g/t Au in AT21-62, 41.2m of 3.94 g/t Au in AT21-63, 64.1m of 3.94 g/t Au in AT21-64, and 48.8m of 2.32 g/t Au in AT21-65, also starting at or near surface from within the Atlanta pit (see January 20, 2022 release).

- Drilling is currently underway on benches to the west of the pit floor, stepping out further down-dip on this high-grade zone, which remains open both to depth and along strike.

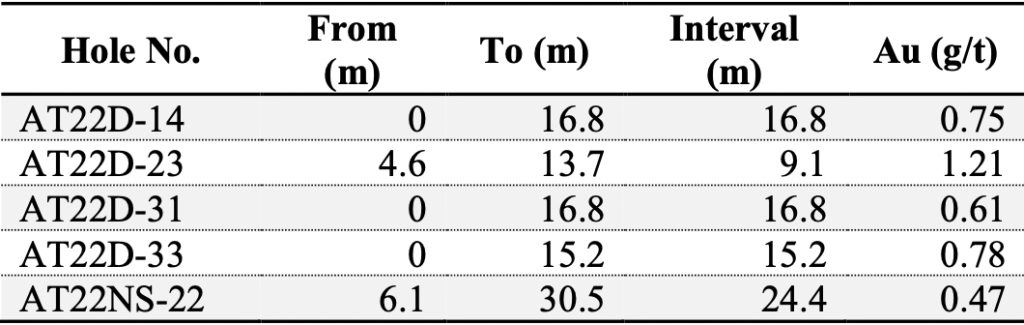

Waste Dumps Drilling Highlights:

- Today’s release also includes results from 24 shallow holes drilled into mine dumps located immediately to the north and west of the historical open pit (Figure 1). In total, these 24 holes average 0.49 g/t Au over a 10.8m thickness within a contiguous area encompassing 59,000m2 (5.9 hectares) and demonstrate a significant amount of gold mineralization in this area.

- This dump-hosted gold mineralization could play an important role in any future mining scenario as an expansion of the Atlanta Pit to the west would necessitate relocating the material. Based on the grades and widths identified in this first pass of drilling, the Company believes there is good potential that a significant portion of this material could be heap leached in any future operations. Additional drilling is planned to further define this mineralization, along with metallurgical testwork to assess its economic potential.

Cal Herron, Exploration Manager of Nevada King, stated, “As reported today, the RC holes located at the bottom of the Atlanta Pit were positioned to firmly establish the location and attitude of the AMFZ’s eastern boundary, prior to initiating the deeper drilling now underway to the west on the high-grade zone’s down-dip extension. We now have a much better understanding of how the Atlanta gold deposit formed, of the host geology and of the controls on the spatial distribution of gold mineralization (see detailed discussion below) that is significantly enhancing our drill targeting. The Company has been rehabilitating benches in the historical pit over the past four months, work that will facilitate drilling of critical structures that were inferred from deep angle holes drilled by previous operators from sites west of the pit. Drilling these structures with predominantly vertical holes will make for a much more accurate structural interpretation and be significantly more cost effective compared to the historical angle holes. Many of the historical holes suffered from poor recovery or failed to fully penetrate the mineralized zones and vertical drilling from these sites should significantly improve recovery particularly in high-grade target areas. Prior operators were likely impeded by access and core recovery issues and we are looking at more thoroughly testing these high-grade target areas.”

Detailed Discussion

Based on our recent drilling the AMFZ’s eastern contact with massive dolomite is a northerly trending, curvilinear plane dipping 75o to 85o west. This major structural boundary defines the eastern limit of the much broader mineralized fault zone that incorporates multiple sub-parallel strands exhibiting vertical displacements ranging up to 75m across individual faults (see Figures 2 and 3). Both normal and reverse displacements are noted. Most of the gold mineralization at Atlanta is hosted within a densely silicified breccia zone that developed along an unconformable contact separating a basal carbonate sequence of Paleozoic-age limestone and dolomite from an overlying Tertiary-age, caldera-related volcanic package consisting of felsic to intermediate composition tuff, volcaniclastics, and epiclastic sediments. This major contact dips 20o to 30o northwestward and generally ranges in thickness from 10m to 40m, although mineralization does extend downward into decalcified dolomite (Figure 2) and upward into the volcanic sequence (Figure 3) in places throughout the deposit. Residual sulfides containing gold are occasionally encountered, but gold mineralization for the most part is strongly oxidized down to depths of 350m. Sulfides do occur in strongly altered volcaniclastics and sediments overlying the mineralized silica breccia zone, but pyritic rock does not generally host gold values greater than 0.1 g/t and appears to be an early stage hydrothermal event that was over-printed by an oxide-dominant gold stage. High-angle, northerly and easterly-trending faults cutting up through both rock sequences served as “feeder structures” for ascending epithermal fluids and channeled gold-bearing solutions into the very porous and receptive silica breccia zone. Higher gold grades tend to be concentrated around the intersections of these high-angle faults with the low-angle silica breccia zone. The strongly argillized volcanic sequence overlying the silica breccia served as a effective seal or cap on top of the hydrothermal system that contained the metalliferous fluid within the breccia zone, thus concentrating the gold mineralization. Rhyolitic dikes and sills were injected into the deposit along the high-angle feeder faults and low-angle breccia zone at about the same time as the gold mineralization, and shallow explosive venting of these intrusions created the distinctive “tuff dikes” that are closely associated both in space and time with the gold event.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by National Instrument 43-101 (“NI 43-101”).

About Nevada King Gold Corp.

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016 Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million-ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King’s portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines’ large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada.

The Company is well funded with cash of approximately $17 million as of October 2022.

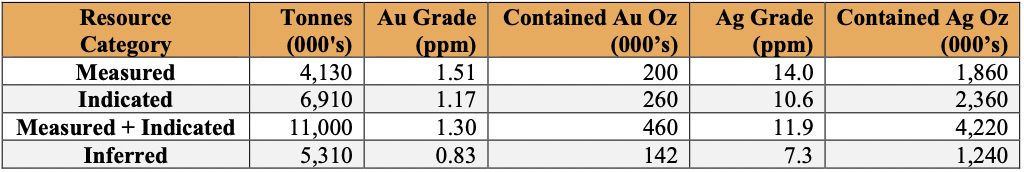

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR (www.sedar.com).

NI 43-101 Mineral Resources at the Atlanta Mine

Please see the Company’s website at www.nevadaking.ca.

For more information, contact Collin Kettell at collin@nevadaking.ca or (301) 744-8744.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating the future operations and activities of Nevada King, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or “should” occur or be achieved. Forward-looking statements in this news release relate to, among other things, exploration plans and the Company’s ability to potentially expand mineral resources and the impact thereon. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Nevada King, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability to complete proposed exploration work given the global COVID-19 pandemic, the results of exploration, continued availability of capital, and changes in general economic, market and business conditions. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Nevada King does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.