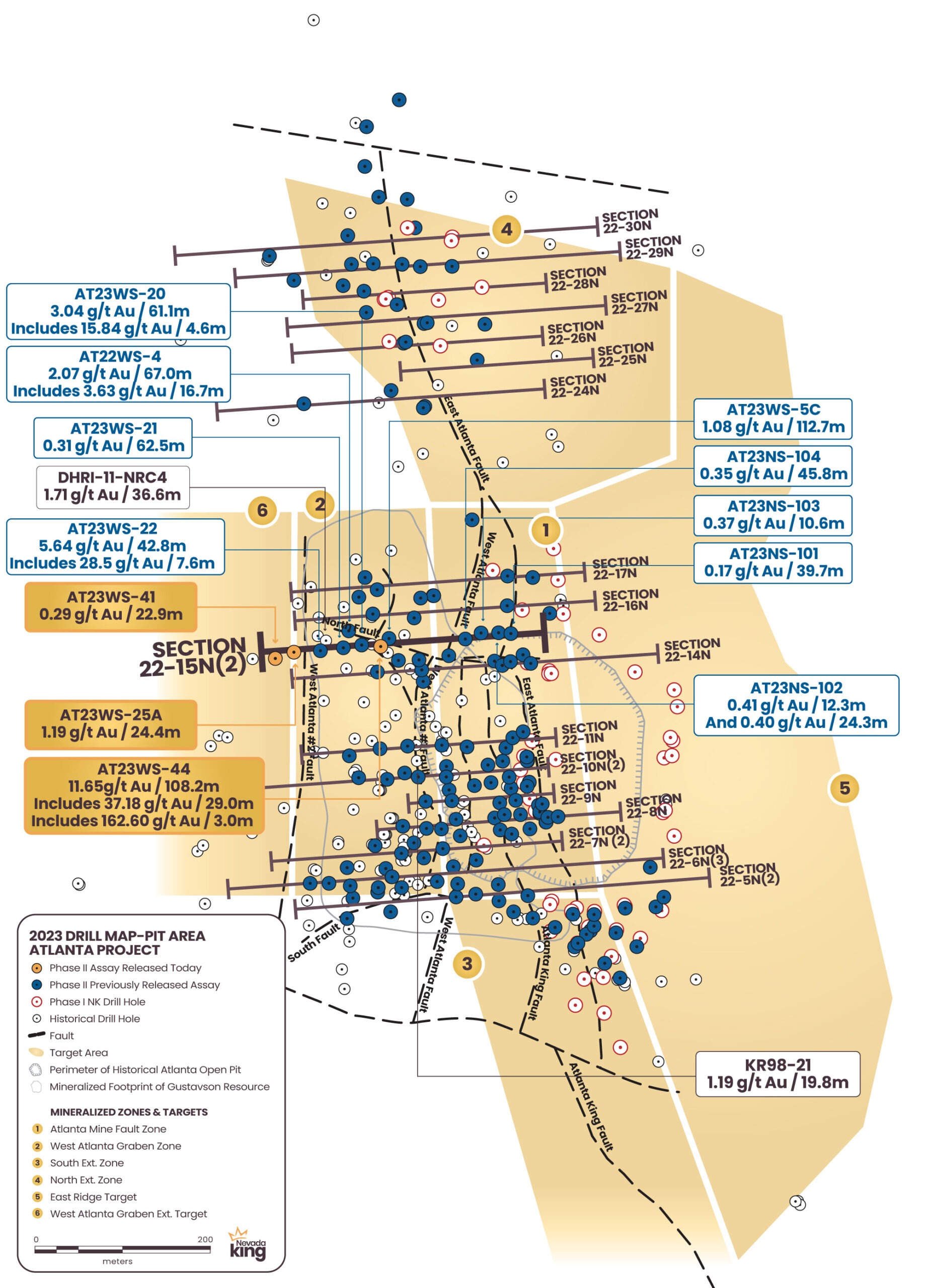

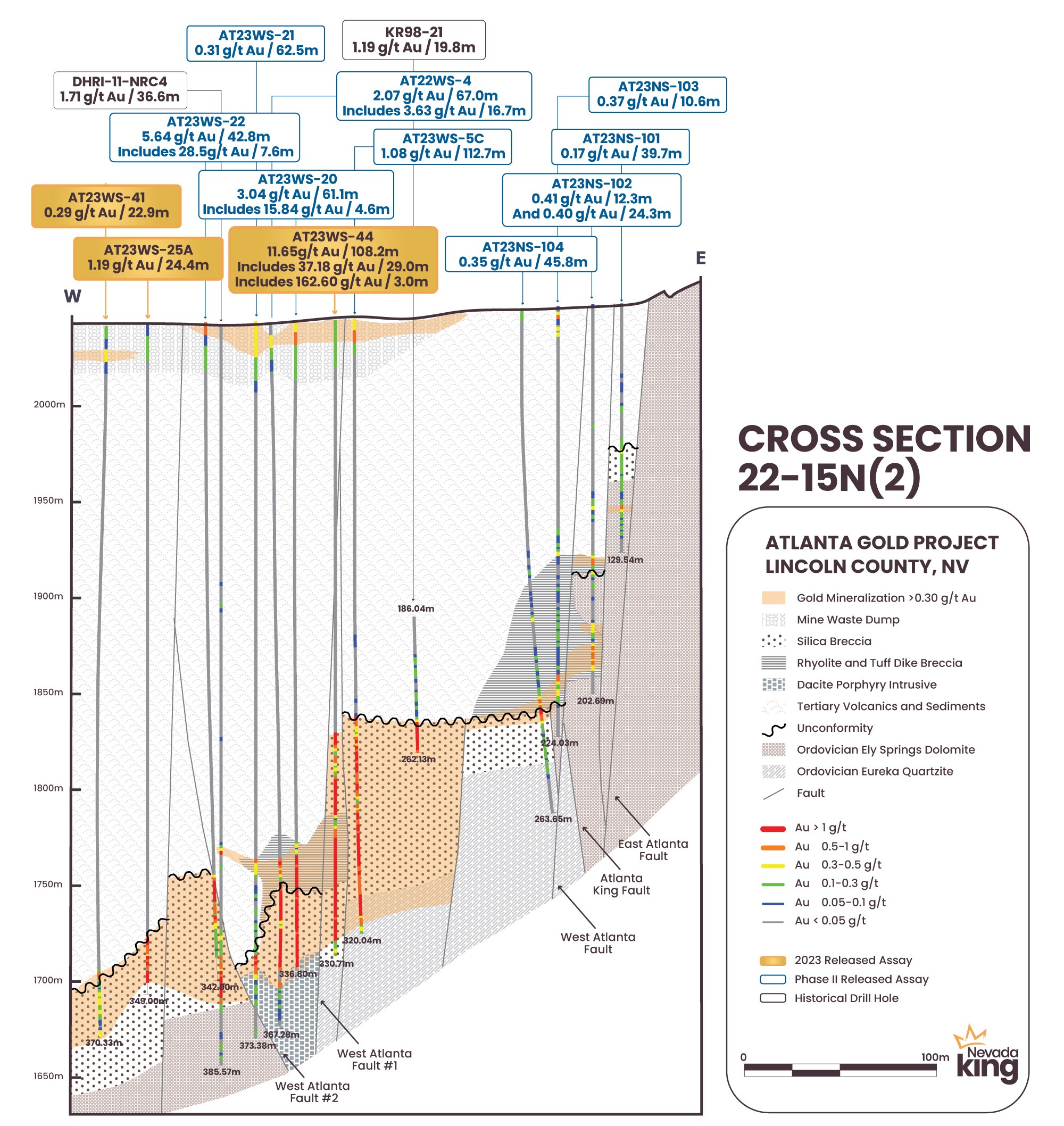

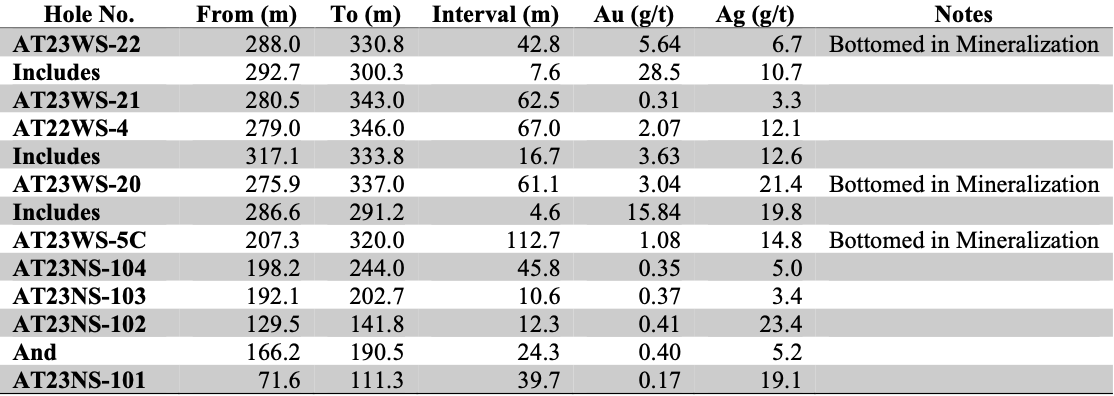

VANCOUVER, BC, October 2, 2023 – Nevada King Gold Corp. (TSX-V: NKG; OTCQX: NKGFF) (“Nevada King” or the “Company”) is pleased to announce assay results from three, vertical reverse circulation (“RC”) holes recently completed at its Atlanta Gold Mine Project located 264km northeast of Las Vegas, Nevada, in the prolific Battle Mountain Trend. These holes were drilled northwest of the Atlanta pit to fill-in drill hole gaps across the northern part of the West Atlanta Graben Zone (“WAGZ”) identifed in Section 22-15N initially reported on April 27, 2023. The three holes reported today are plotted on plan and section in Figures 2 and 3.

Highlights:

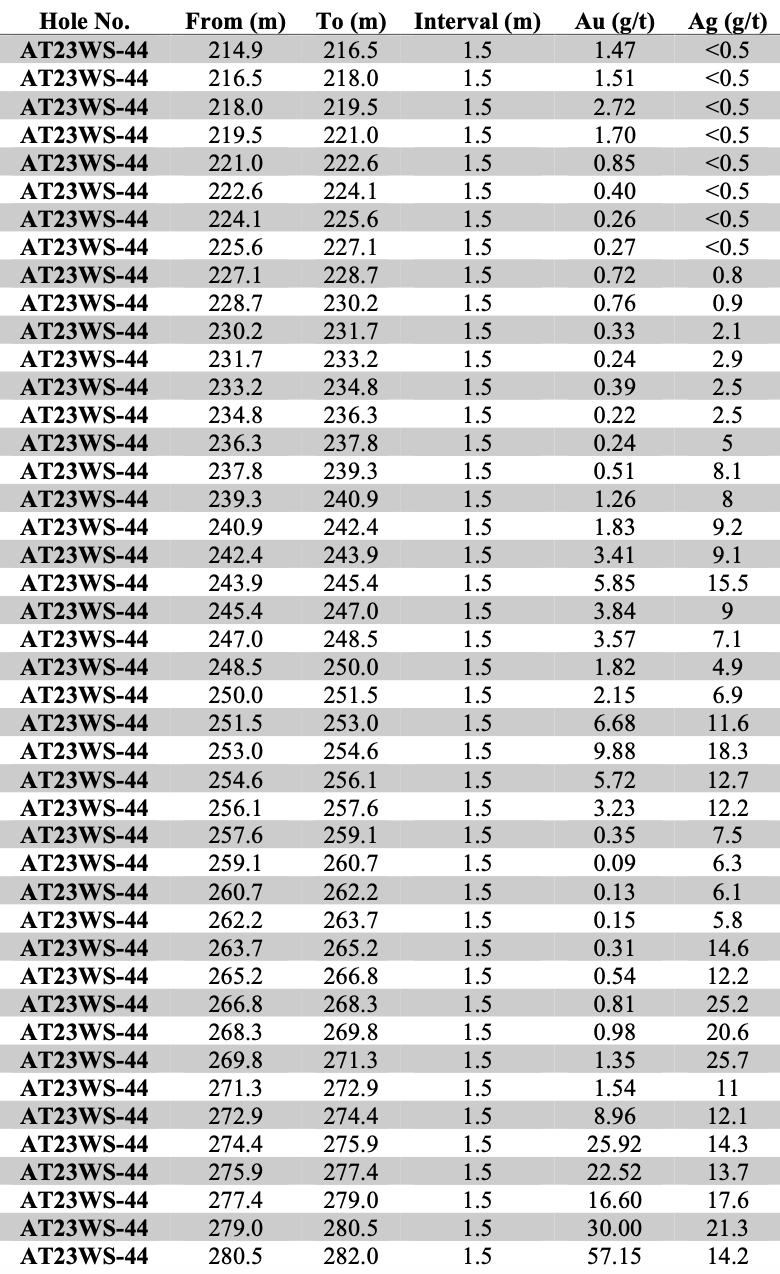

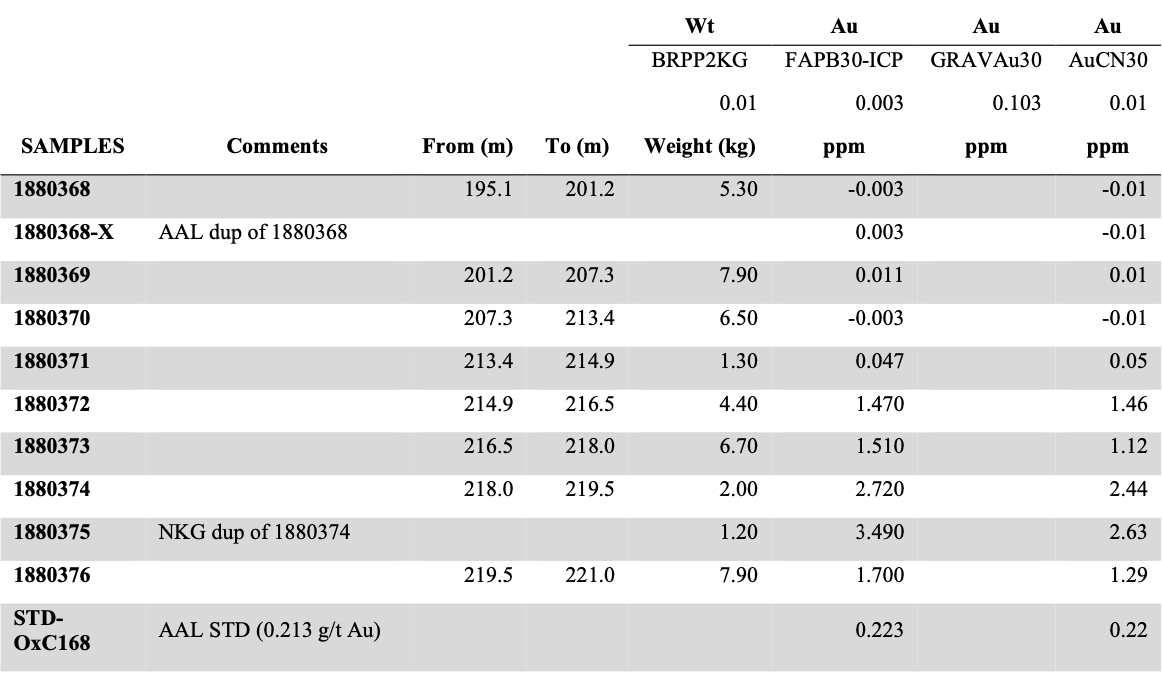

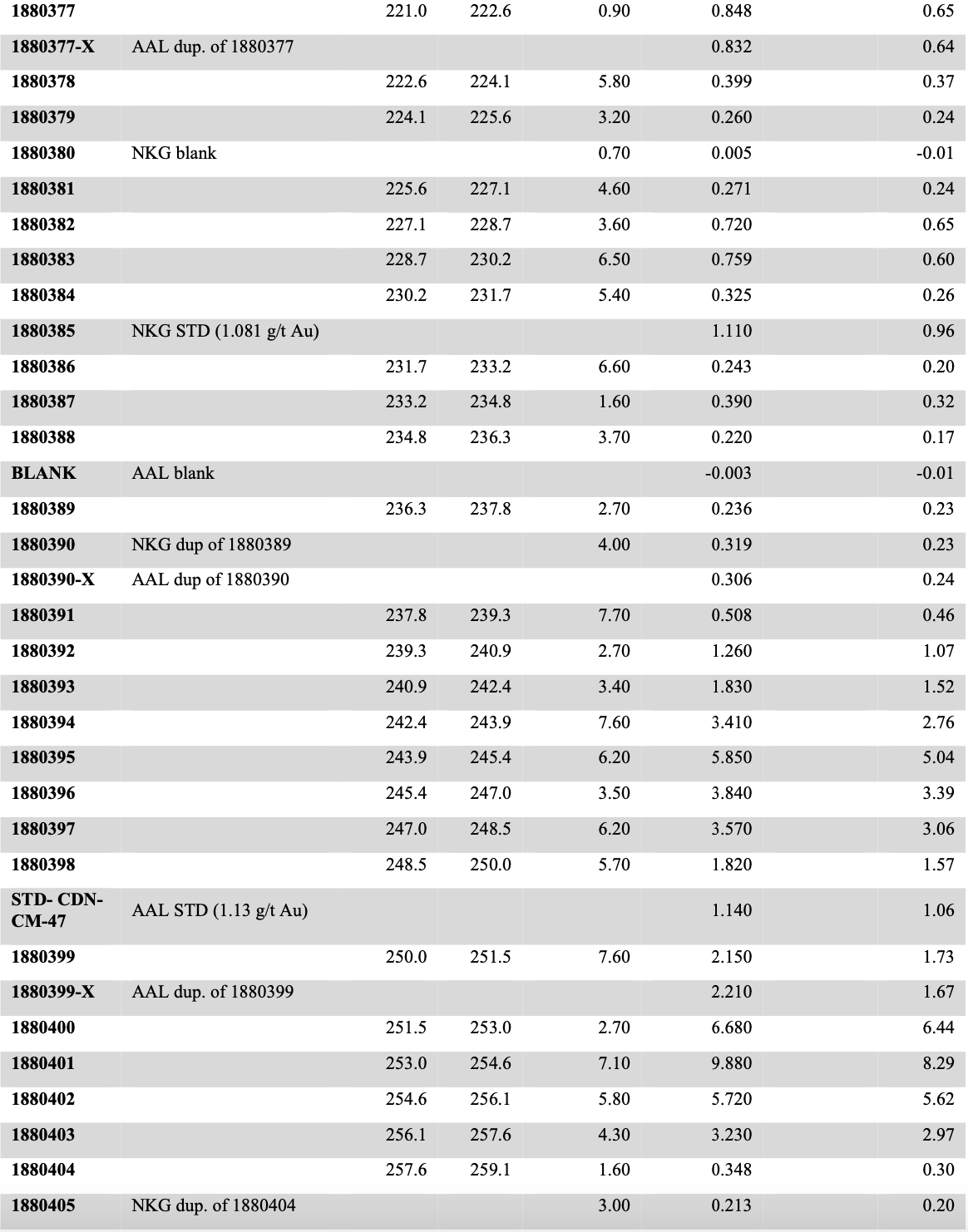

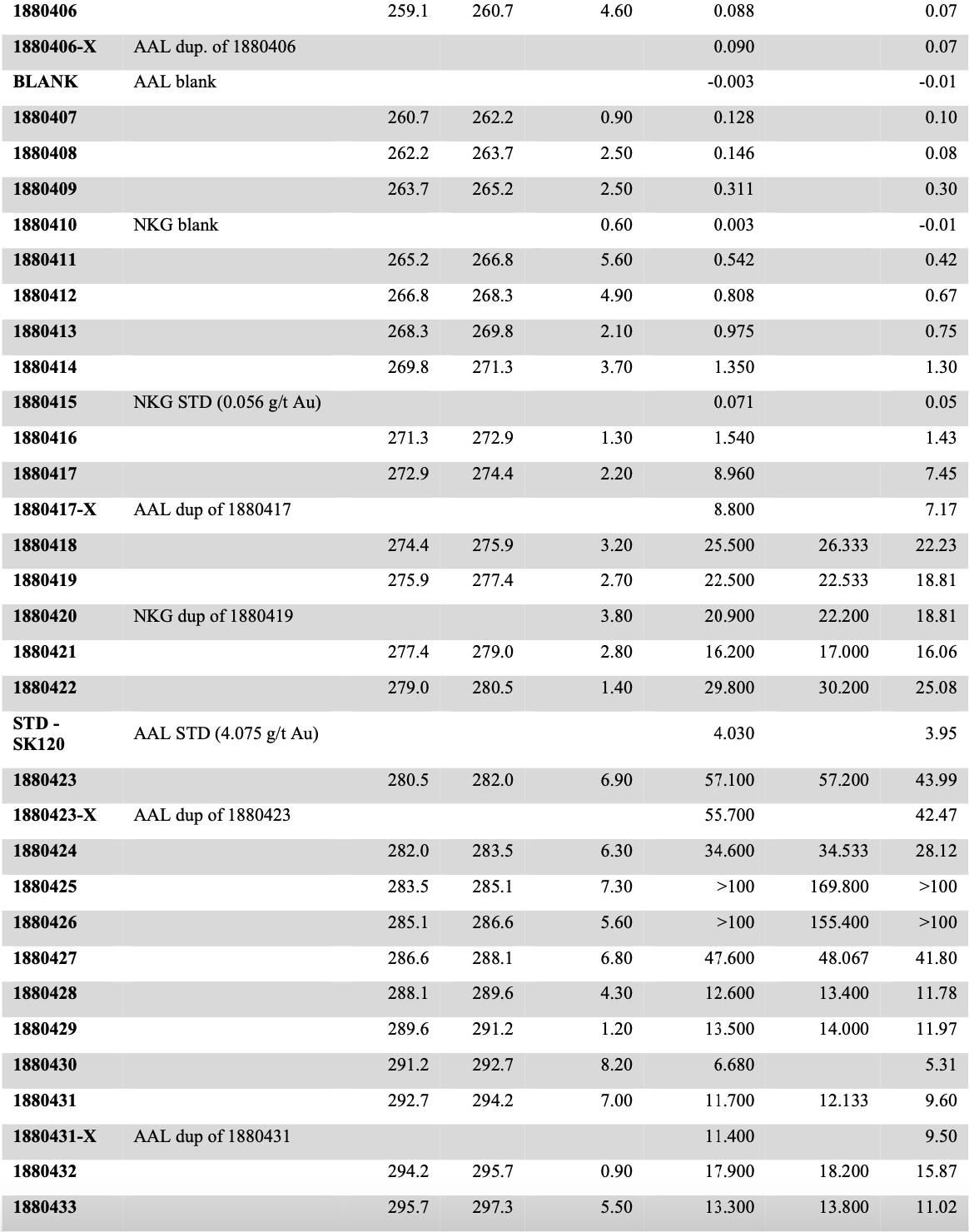

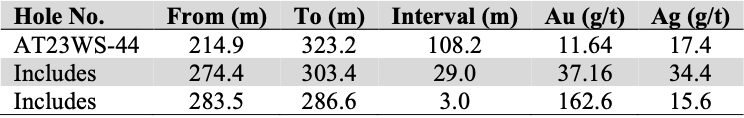

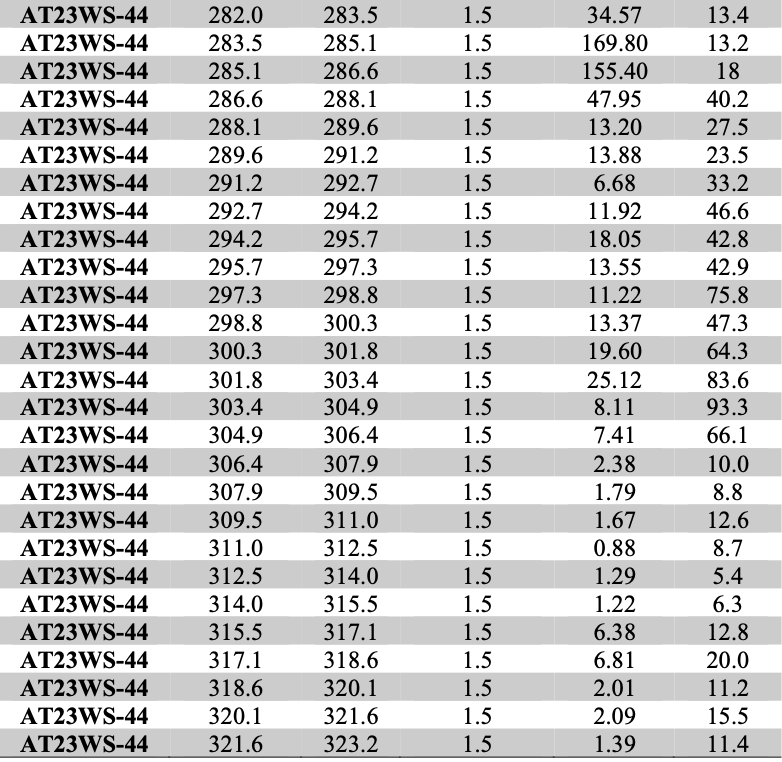

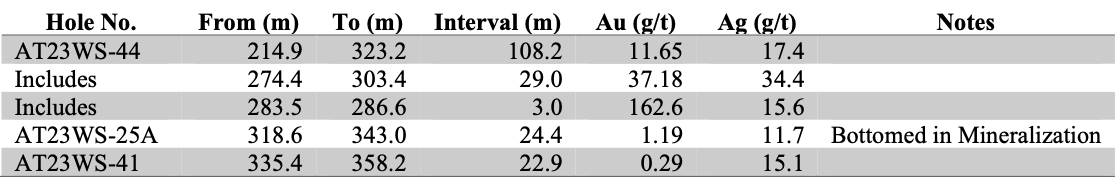

- 11.64 g/t Au over 108.2m, including 37.16 g/t Au over 29.0m in AT23WS-44 is the most gold rich drill hole ever recorded at Atlanta and contains the highest-grade individual drill assay interval ever reported from the project of 169.8 g/t Au over 1.5m. See Table 2 below for a detailed breakdown of the full 29m high grade interval and Table 3 for the complete detailed breakdown of the 108.2m intercept.

- AT23WS-44 was sited 120m northwest of the Atlanta pit to locate and test the West Atlanta Fault #1 (WAF1) and was collared 20m west of previously reported AT22WS-5C (1.08 g/t Au over 112.7m) and 22m east of previously reported AT23WS-20 (3.04 g/t Au over 61.1m).

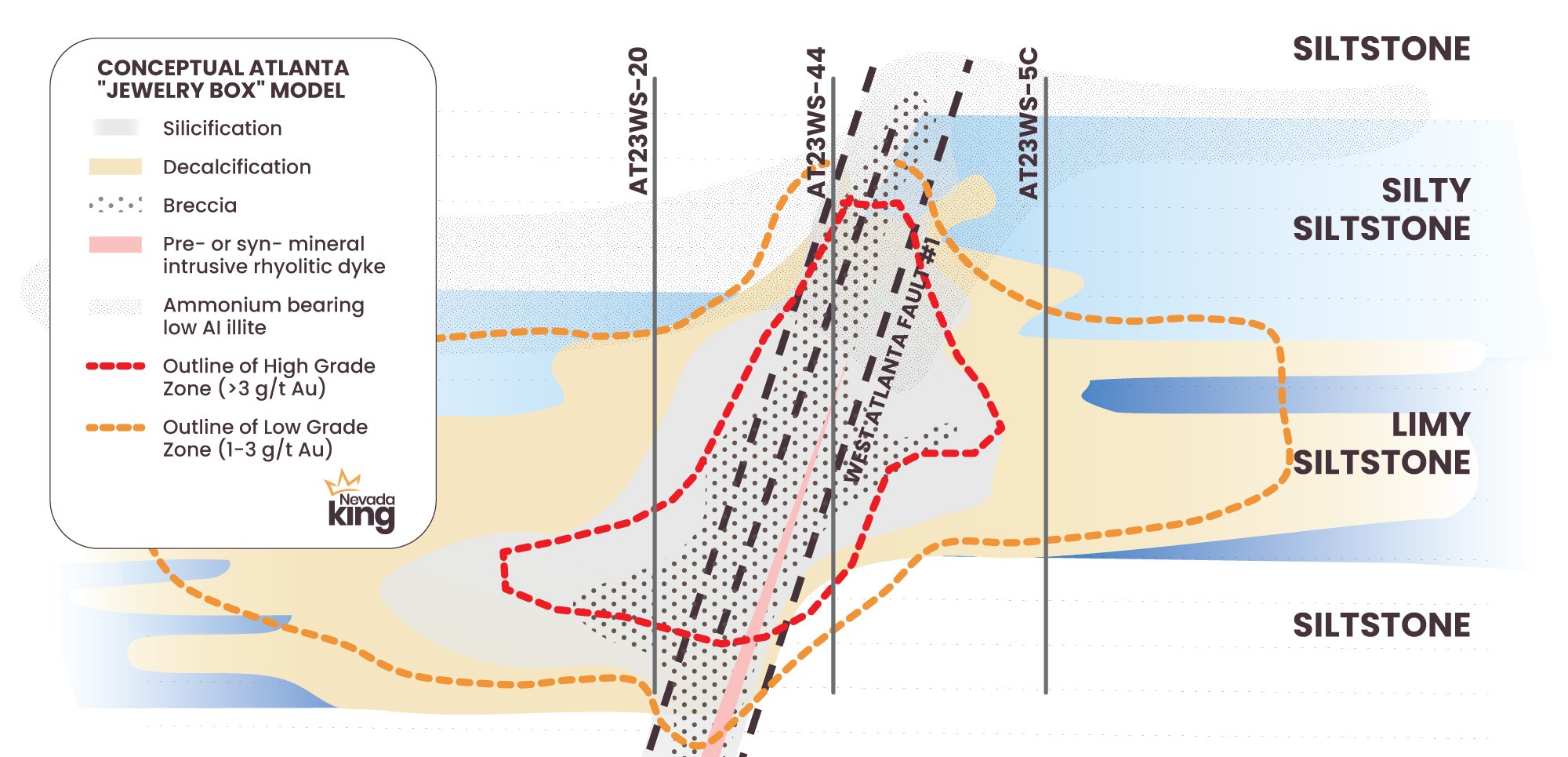

- The Company’s new geological model supports the presence of very high-grade zones or ‘jewelry boxes’ that can occur at the juncture between sub-vertical feeder zones and flat-lying horizons of replacement-type (Carlin-type) mineralization. Figure 1 below depicts a conceptual cross section across the high-grade feeder zone hit in AT23WS-44 based on a generalized Carlin-type geological model.

- As shown above, AT23WS-44 is interpreted to have penetrated the mineralized zone near the middle of a high-grade zone close to and possibly intersecting the WAF1. AT23WS-20 intersected the western portion of the +3 g/t Au high-grade zone while AT23WS-5C on the east narrowly missed the high-grade domain.

- Now with WAF1 firmly located, the Company is planning to follow up on AT23WS-44 with closely spaced vertical holes east and west to better determine the lateral extent and grade distribution in and around the feeder structure, while also following it along strike, where it remains open to the north and south.

- Mineralization in this high-grade interval is strongly oxidized as demonstrated by the Au cyanide solubility analyses in Table 2 below. Visible gold has not been observed in the cuttings. The absence or paucity of coarse-grained gold is supported by the consistent results from duplicate fire assays of all high-grade intervals (see Table 7).

Cal Herron, Exploration Manager of Nevada King, stated, “Today’s high-grade interval in AT23WS-44 gives us another starting point for tracking higher-grades proximal to high-angle feeder structures cutting up through the flat lying horizons that correlate to stratigraphy hosting most of the gold at Atlanta – namely the silica breccia and overlying silicified volcanic horizons. As seen in Figures 1 and 3, the rhyolitic intrusive breccia hosting the highest grade mineralization in the hole probably intruded along the WAF1 and will be easy to visually track in the up-coming offset holes of AT23WS-44 that will be drilled to further expand upon this “bonanza grade” mineralization. It is important to note that the high-grade “core” mineralization seen in AT23WS-44 (29m @ 37.16 g/t Au) is not related to a narrow vein that was drilled down, but rather occurs within the same flat-lying replacement horizon penetrated in surrounding holes at similar elevation – i.e. 1741m–1770m a.s.l (above sea level). For example, nearby holes in the northern portion of the WAGZ intersected the following high-grade mineralization –

- AT23WS-20, located 20m west of AT23WS-44, returned 27.6m @ 4.67 g/t Au from 1730m-1758m a.s.l.

- AT23WS-22, located 68m west of AT23WS-44, returned 7.6m @ 28.5 g/t Au from 1743-1750m a.s.l.

- AT22WS-2, located 41m north of AT23WS-44, returned 33.6m @ 4.10 g/t Au from 1746m-1780m a.s.l.

- AT23WS-23, located 63m northwest of AT23WS-44, returned 12.2m @ 8.78 g/t Au from 1745m-1757m a.s.l.

Elsewhere within the Atlanta resource zone we see very similar elevation control over high-grade mineralization. Examples near the East Atlanta Fault within the AMFZ include –

- AT21-62 returned 10.7m @ 11.19 g/t Au from 1942m-1953m a.s.l.

- AT23NS-116 returned 4.6m @ 7.31 g/t Au from 1937m-1942m a.s.l.

- AT22NS-81T returned 5.3m @ 10.73 g/t Au from 1925m-1931m a.s.l.

The same pattern is apparent across the southern portion of the WAGZ –

- AT22-8T returned 13.4m @ 7.65 g/t Au from 1879m-1893m a.s.l.

- AT22SE-42 returned 13.7m @ 4.05 g/t from 1864m-1888m a.s.l.

- AT23HG-28 returned 12.2m @ 7.59 g/t Au from 1841m-1854m a.s.l.

- AT23HG-34 returned 27.4m @ 4.50 g/t Au from 1841m-1870m a.s.l.

- AT22HG-13 returned 12.2m @ 17.59 g/t Au from 1875m-1887m a.s.l.

The high grade intercepts cited above occur within discrete groups or clusters located across the entire resource zone, with holes in each cluster sharing the same elevation ranges. This argues strongly for the high-grades being hosted within near-horizontal replacement horizons versus narrow, high-angle faults/veins. If these intercepts occurred along high-angle fault surfaces, we would not see a uniform horizontal geometry, instead the intercept elevations within an individual cluster of holes proximal to each other would indicate a steeply dipping plane. Close-spaced drilling along suspected high-grade zones has now provided Nevada King with enough information to concentrate on drill-defining these relatively narrow (<20m wide) but very high-grade, linear intersection zones involving high-angle “feeder” faults and flat-lying replacement horizons.”

Additional Details:

- Holes AT23WS-25A (24.4m grading 1.19 g/t Au from 318.6 to 343.0m) and AT23WS-41 (22.9m grading 0.293 g/t Au from 335.4 to 358.2m) were drilled west of previously reported hole AT23WS-22 (42.8m @ 5.64 g/t Au) in order to define the western boundary of the WAGZ. Both of these new holes hit deeper, lower grade mineralization on the west side of the West Atlanta Fault #2 (WAF2), which bounds the western margin of the WAGZ. Gold grade in this area clearly decreases westward from the WAF2.

- The high grade intercept in previously reported hole AT23WS-22 (42.8m @ 5.64 g/t Au) is attributed to close proximity to the WAF2. Now that we know where this fault is located, we will be drilling along strike of it to the north and south in order to further extend the higher-grade mineralization.

- Additional in-fill drilling is needed between AT23WS-5C and AT23NS-104 in order to fill a large 88m gap that currently exists between AT23WS-5C and the West Atlanta Fault (see Figure 3).

Detailed Interpretation:

The Company’s interpretation of today’s highlight interval is that gold mineralizing fluids have migrated laterally from the high-angle WAF1 (the feeder structure) into a larger receptive, flat-lying breccia horizon with gold grades generally decreasing gradationally with horizontal distance from the feeder structure (Figure 1). The Company does not have sufficient data to accurately estimate true width of the high grade feeder structure, but true thickness of the high grade zones within the overall flat-lying mineralized horizon is far more apparent. As an example, simply comparing the 29m-thick high grade intercept (37.16 g/t Au) in AT23WS-44 with the 27.4m high grade intercept (4.67 g/t Au) in AT23WS-20 illustrates the flat-lying nature of the high grade horizon connecting these two holes. The mineralized zone in AT23WS-44 starts at an elevation of 1770m a.s.l. (above sea level) while the same mineralized horizon in AT23WS-20, located 21m to the west of AT23WS-44, starts at an elevation of 1758m a.s.l. This flat-lying geometry to the replacement horizon is noted throughout the Atlanta deposit as discussed above.

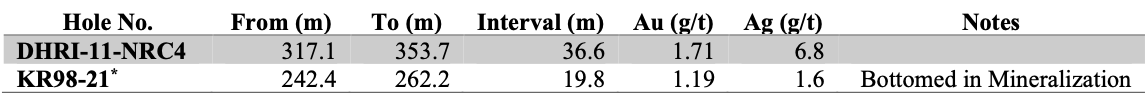

*Denotes angle hole.

QA/QC Protocols

All Reverse Circulation (RC) samples from the Atlanta Project are taken at 1.5 m intervals, split at the drill site and placed in cloth and plastic bags utilizing a nominal 2kg sample weight. Certified Reference Material (CRM) standards, blanks, and blind duplicates are inserted into the sample stream on-site on a one-in-twenty sample basis, meaning all three control inserts are included in each 20-sample group. Samples are shipped by a local contractor in large sample shipping crates directly to American Assay Lab in Reno (“AAL”), Nevada, with full custody being maintained at all times. At AAL, samples were weighed then crushed to 75% passing 2mm and pulverized to 85% passing 75 microns in order to produce a 300g pulverized split. Prepared samples are initially run using a four acid + boric acid digestion process and conventional multi-element ICP-OES analysis. Gold assays are initially run using 30-gram samples by lead fire assay with an OES finish to a 0.003 ppm detection limit, with samples greater than 10 ppm finished gravimetrically. Every sample is also run through a cyanide leach for gold with an ICP-OES finish. For Au values above 10 g/t, AAL routinely re-assays samples using a 30gm gravimetric fire assay. For the 29m high grade interval in AT23WS-44, AAL inserted three lab duplicates that results in percent differences of 1.80%, 2.48%, and 2.59%. No visible gold was logged in this hole.Sample weights were consistent.

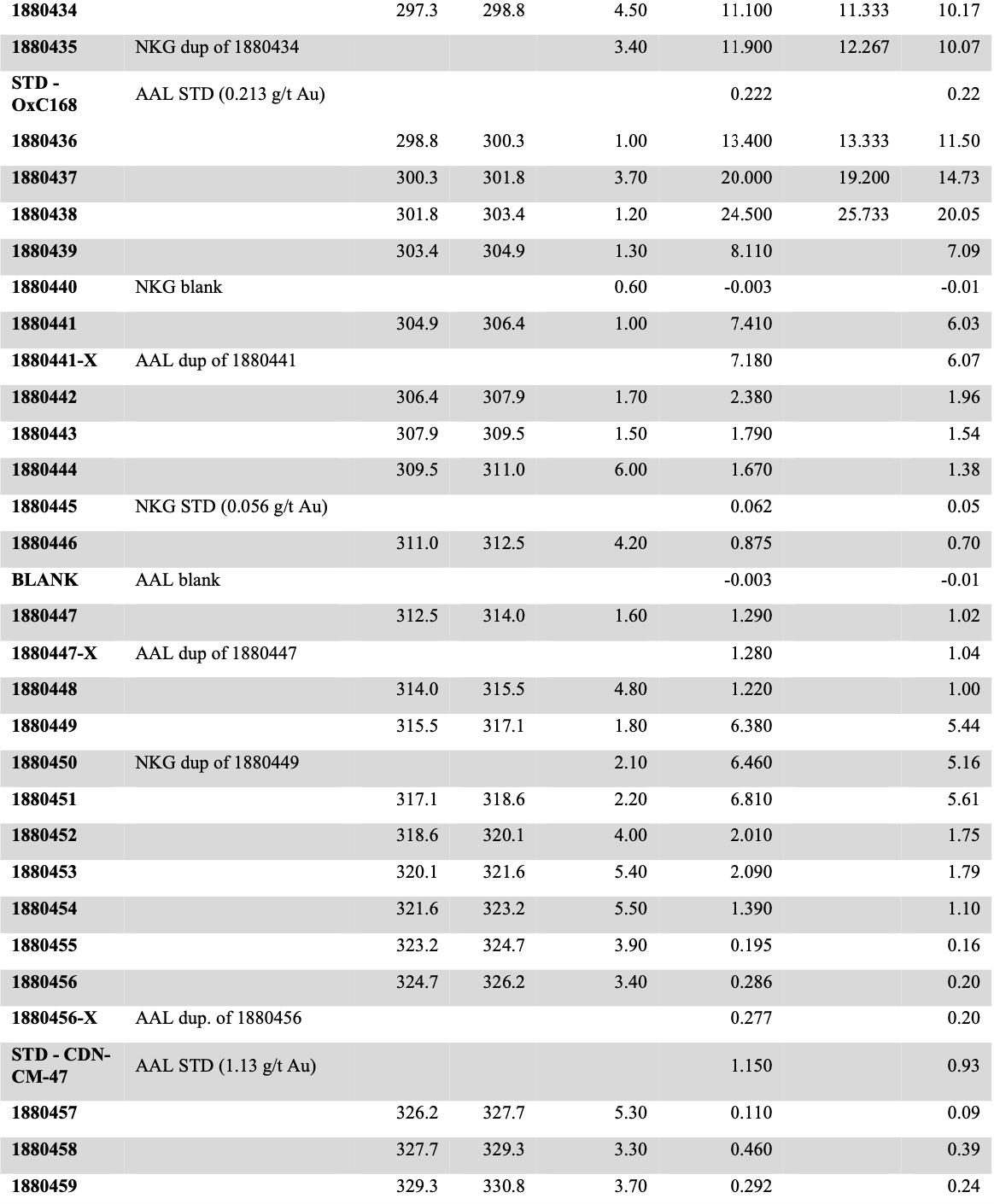

Table 7 contains the complete assay report for the interval 195.1m to T.D. at 330.8m for AT23WS-44 showing sample weights as received at American Assay Lab plus lab blank, duplicate, and CRM standards along with Nevada King’s inserted field blanks, duplicates, and CRM standards. The high grade intervals were assayed by 30gm fire with ICP finish and then check-assayed via 30 gm gravimetric fire assay. Gold cyanide solubility assays were performed on every sample. As seen in Table 6, the 30gm ICP analyses match closely with the gravimetric analyses, indicating minimal nugget effect and high reproducibility. The consistent Au cyanide analyses indicate strong oxidation and little evidence of significant sulfide encapsulation. Fairly consistent sample weights indicate good, overall RC recovery, particularly within the very high grade intervals, to the extent that down-hole contamination from upper high grade intervals is unlikely. When 10m to 20m lengths of low sample weights occur, or sustained lack of sample recovery occurs, then down-hole contamination is more likely to occur. This is not the case with AT23WS-44.

AAL-inserted CRM Standards:

CDM-CM-47 1.13 g/t Au +/- 0.11 g/t Canadian Resource Lab. Ltd., Langley B.C.

OxC168 0.213 g/t Au +/- 0.002 g/t Rock Labs, Auckland NZ

SK120 4.075 g/t Au +/- 0.03 g/t Rock Labs, Auckland NZ

NKG-inserted CRM Standards:

Batch # 75226 0.056 g/t Au +/- 0.003 g/t Klen International Pty. Ltd., Neerabup Western Australia

Batch # 73915 1.081 g/t Au +/- 0.03 g/t Klen International Pty. Ltd., Neerabup Western Australia

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by NI 43-101.

About Nevada King Gold Corp.

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016, the Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million-ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King’s portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines’ large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada.

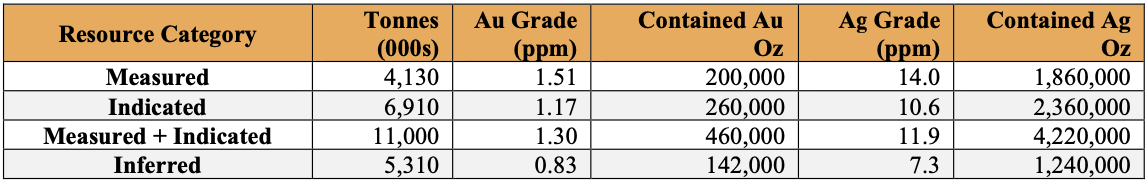

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR+ (www.sedarplus.ca).

Please see the Company’s website at www.nevadaking.ca.

For more information, contact Collin Kettell at collin@nevadaking.ca or (845) 535-1486.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating the future operations and activities of Nevada King, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or “should” occur or be achieved. Forward-looking statements in this news release relate to, among other things, the Company’s exploration plans and the Company’s ability to potentially expand mineral resources and the impact thereon. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Nevada King, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability to complete proposed exploration work given the global COVID-19 pandemic, the results of exploration, continued availability of capital, and changes in general economic, market and business conditions. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Nevada King does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.