NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC, May 12, 2023 – Nevada King Gold Corp. (TSX-V: NKG) (“Nevada King” or the “Company”) is pleased to announce that it has closed the brokered portion of its previously announced financing for gross proceeds of $5-million (the “LIFE Offering”). The LIFE Offering was led by Canaccord Genuity Corp. as lead agent and sole bookrunner, on behalf of a syndicate of agents that included Roth Canada Inc. (collectively the “Agents”).

Collin Kettell, Founder & CEO of Nevada King, commented: “With the closing of this offering, we welcome six new institutions and funds to our growing roster of shareholders. These six orders constitute over 90% of the $5-million LIFE financing, which was priced at market and without a warrant. Achieving this pricing in light of difficult market conditions is a testament to the level of investor confidence in the trajectory of the Atlanta Gold Mine Project discovery. The concurrent $11.25-million non-brokered portion of the financing is being taken almost entirely by existing shareholders, and upon closing, Nevada King will be well financed for an aggressive 2023 exploration season and beyond.”

The Company is continuing with the non-brokered portion of its financing (the “Non-Brokered Private Placement” and together with the LIFE Offering, the “Offering”) for additional gross proceeds of $11.25-million. The Non-Brokered Private Placement is fully allocated and is expected to close on or about May 26, 2023. The total gross proceeds of the Offering, after the completion of the Non-Brokered Private Placement are expected to be $16.25-million.

In connection with the LIFE Offering, the Company issued 11,111,111 common shares for a purchase price of $0.45 per common share. The common shares issued under the LIFE Offering were issued by way of the Listed Issuer Financing Exemption under Part 5A of National Instrument 45-106 – Prospectus Exemptions and are not subject to resale restrictions pursuant to applicable Canadian securities laws or the policies of the TSX Venture Exchange (“TSX-V”).

In connection with the LIFE Offering, the Agents received an aggregate cash fee equal to $250,000.

The net proceeds of the Offering are intended to be used to advance Nevada King’s development and exploration stage assets and for other general corporate purposes.

For further information regarding the Non-Brokered Private Placement, please see the Company’s news releases dated May 1, 2023, May 3, 2023, and May 10, 2023. The issuance of the common shares under the Non-Brokered Private Placement remains subject to customary conditions, including, but not limited to, the receipt of all necessary approvals, inclusive of the approval of the TSX-V.

The securities offered under the Non-Brokered Private Placement have not been registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This release does not constitute an offer to sell or a solicitation of an offer to buy of any securities in the United States. The securities described herein have not been, and will not be, registered under the U.S. Securities Act, or any state securities laws, and may not be offered or sold within the United States except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities laws or pursuant to available exemptions therefrom.

About Nevada King Gold Corp.

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016 the Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King’s portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines’ large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada. The Company is well funded with cash of approximately $10 million after closing of LIFE Offering.

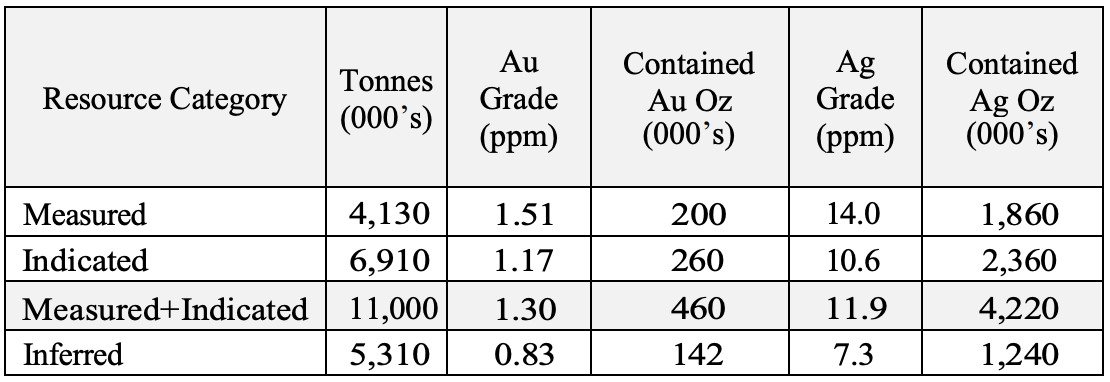

The Atlanta Mine is a historical gold-silver producer with a National Instrument 43-101 (“NI 43-101”) compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR (www.sedar.com).

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by NI 43-101.

NI 43-101 Mineral Resources at the Atlanta Mine

Please see the Company’s website at www.nevadaking.ca.

For more information, contact Collin Kettell at collin@nevadaking.ca or (845) 535-1486.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or” should” occur or be achieved. All statements, other than statements of historical fact, included herein, without limitation, statements relating the closing of the Non-Brokered Private Placement, TSX-V approval of the Non-Brokered Private Placement, the use of proceeds with respect to the Offering, and the results of the mineral resource estimate on the project are forward-looking statements. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Nevada King, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability to complete proposed exploration work given the global COVID-19 pandemic, the results of exploration, continued availability of capital, and changes in general economic, market and business conditions. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Nevada King does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.