NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC, February 12, 2024 – Nevada King Gold Corp. (TSX-V: NKG) (“Nevada King” or the “Company”) is pleased to announce that the Company’s Board of Directors has unanimously approved plans for a strategic reorganization of its business pursuant to which all of the Company’s concessions and properties with the exception of the Atlanta Gold Mine Project (“Atlanta”) will be spun out to Nevada King shareholders (the “Spin-Out”) through a newly incorporated company (“SpinCo”). In connection with the Spin-Out, Nevada King proposes to also grant to SpinCo a 3.0% royalty on all production from certain portions of Atlanta including the Atlanta resource area and non-core claims surrounding the Atlanta Gold Mine Project.

The Company is also proceeding with a non-brokered private placement financing (the “Non-Brokered Private Placement”) of 27,857,143 common shares of the Company (“Common Shares”) at a price of $0.35 per Common Share for aggregate gross proceeds of $9.75-million. The Non-Brokered Private Placement is fully allocated to insiders, existing shareholders, and a new strategic shareholder of the Company. Proceeds of the Non-Brokered Private Placement will be used to advance the Atlanta Gold Mine Project and for working capital purposes of Nevada King.

Highlights:

- The Spin-Out will provide investors with an ownership stake in two separate specialized companies. Nevada King will continue to focus exclusively on the advancement of the Atlanta Gold Mine Project, while the newly created SpinCo will focus on advancing its foothold as the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. SpinCo will control over 193,000 acres (9,682 claims) along the Battle Mountain Trend with key project areas hosting significant historical exploration work and possessing untested discovery potential. These project areas include Iron Point, Buffalo Valley, Lewis, Horse Mountain-Mill Creek, Hilltop South, Carico Lake, Kobeh Valley, and Pancake South.

- Company Founder & Chief Executive Officer Collin Kettell is subscribing for $2,000,000 of the Non-Brokered Private Placement, while other members of management and the board of directors are also participating.

- Two significant shareholders of the Company are subscribing for $4,200,000 and $1,345,000 of the Non-Brokered Private Placement, respectively. A new strategic shareholder to the Company is subscribing for $2,000,000. Between participation of the new strategic shareholder, as well as management and significant shareholders, the Non-Brokered Private Placement is fully allocated.

“We are pleased to announce these two exciting opportunities for the Company. Creating a standalone focused company holding Nevada King’s large portfolio of claims along the Battle Mountain trend will create an exciting growth-focused story with a dominant land position along one of the world’s most prolific gold mining trends. This project portfolio is nestled amongst some of North America’s most prominent current and former producing mines and has the potential to provide exceptional exploration upside and optionality from multiple properties,” Collin Kettell, CEO of Nevada King stated. “At the same time, the fully allocated Non-Brokered Private Placement, which is priced at market and without a warrant, will allow Nevada King to fast track drilling at Atlanta, where we have continually intersected high-grade oxide results over significant thicknesses. We will be creating value for shareholders on two fronts now, with SpinCo providing exposure to significant exploration potential while Nevada King continues to develop its flagship Atlanta Gold Mine Project.”

“Finally, I would like to provide a special thank you to our dedicated and growing group of significant shareholders whose support and long-term vision for Nevada King has allowed us to accelerate the advancement of Atlanta despite difficult equity conditions for the gold exploration sector.”

Spin-Out

The Spin-Out will be completed as part of a strategic reorganization to unlock value in Nevada King’s large portfolio of mineral claims in the State of Nevada. The target areas along the Battle Mountain trend to be held by SpinCo include the Company’s Lewis, Horse Mountain-Mill Creek, and Iron Point projects. Nevada King will also grant SpinCo a net smelter return (“NSR”) royalty in the amount of 3.0% from all production from certain non-core Atlanta claims surrounding Atlanta, as well as a 3.0% NSR royalty on the core “Bobcat” claims that cover the existing resource zone. The 3.0% NSR royalty on the Bobcat claims will take effect upon fulfilling the existing royalty on the Bobcat claims which is a 3.0% royalty capped at the first 4,000 ounces of gold equivalent production.

It is proposed that the Spin-Out will proceed by way of a statutory plan of arrangement (the “Arrangement”) pursuant to the Business Corporations Act (British Columbia). Common shares of SpinCo (the “SpinCo Shares”) will be distributed to shareholders of Nevada King in proportion to their shareholdings of Nevada King. There will be no change in Nevada King shareholders’ holdings in the Company as a result of the Spin-Out.

Completion of the proposed Spin-Out will be subject to finalizing the terms of a definitive arrangement agreement to be entered into between Nevada King and SpinCo, as well as the approval of the Nevada King shareholders, and the approvals of the British Columbia Supreme Court and the TSX Venture Exchange (the “TSXV”).

SpinCo will not initially be listed on a public stock exchange but will operate as a reporting issuer.

Further details of the Spin-Out will be provided as the transaction progresses. Timing of the Spin-Out will be based on prevailing market conditions. The particulars of the Spin-Out are not yet final and shareholders are cautioned that there can be no assurance that the Spin-Out will be completed on the terms described herein or at all.

Private Placement

The securities offered in the Non-Brokered Private Placement have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This release does not constitute an offer to sell or a solicitation of an offer to buy of any securities in the United States. The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and may not be offered or sold within the United States except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities laws or pursuant to available exemptions therefrom.

Related Party Participation in the Non-Brokered Private Placement

Certain insiders of the Company, including Collin Kettell (CEO and Director), expect to participate in the Non-Brokered Private Placement. The participation by insiders in the Non-Brokered Private Placement constitutes a “related party transaction” as defined under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company is relying on the exemptions from the valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101, as neither the fair market value of the Common Shares purchased by insiders, nor the consideration for the Common Shares paid by such insiders, will exceed 25% of the Company’s market capitalization. The Company expects that the closings of the Non-Brokered Private Placement will occur within 21 days of this announcement and that it will not file a material change report in respect of the related party transaction at least 21 days before the closings. The Company deems this circumstance reasonable in order to complete the Non-Brokered Private Placement in an expeditious manner. The Non-Brokered Private Placement has been unanimously approved by the Company’s board of directors. Further information regarding the interest in the Non-Brokered Private Placement of every related party and the effect that the Non-Brokered Private Placement will have on their percentage of securities of the Company will be provided once finalized.

About Nevada King Gold Corp.

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016 the Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King’s portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines’ large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada.

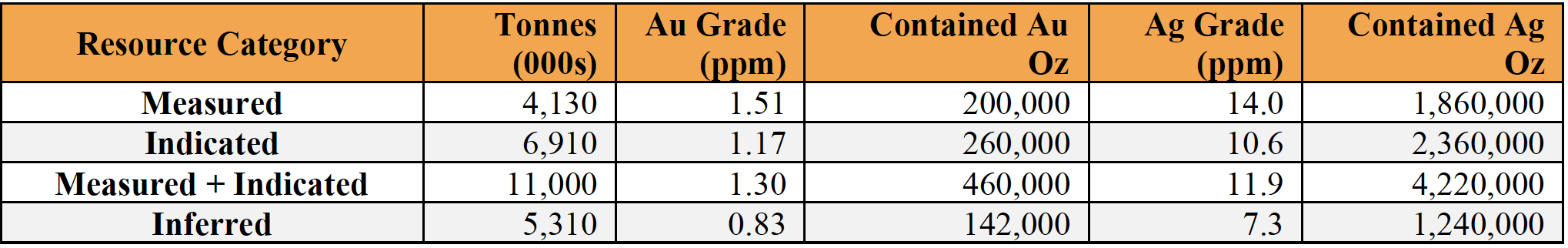

The Atlanta Mine is a historical gold-silver producer with a National Instrument 43-101 (“NI 43-101”) compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR+ (www.sedarplus.com).

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by NI 43-101.

Please see the Company’s website at www.nevadaking.ca.

For more information, contact Collin Kettell at collin@nevadaking.ca or (845) 535-1486.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or” should” occur or be achieved. All statements, other than statements of historical fact, included herein, without limitation, statements relating the proposed terms of the Spin-Out, completion of the Spin-Out, the closing of the Non-Brokered Private Placement, TSXV approval of the Spin-Out and the Non-Brokered Private Placement, the use of proceeds with respect to the Non-Brokered Private Placement, and the benefits of the proposed Spin-Out and Non-Brokered Private Placement are forward-looking statements. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Nevada King, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability to complete proposed exploration work, the results of exploration, continued availability of capital, and changes in general economic, market and business conditions. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Nevada King does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.